Starting Fresh

WHAT YOU’LL FIND INSIDE:

- STARTING FRESH

- CALENDAR

- DON NAMED TO CHAIRMAN’S COUNCIL

- YEAR-END DEADLINES

- NEW LEGISLATION FOR QCDs

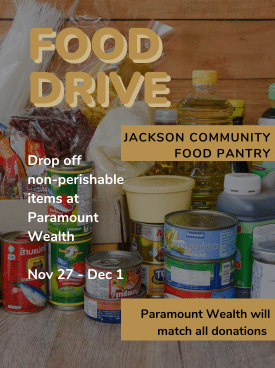

- LAST DAY FOR FOOD DRIVE

From all of us at Paramount Wealth, we wish you a very Merry Christmas and a healthy and prosperous New Year!

**Please note – Our office will be closing at 1:00 pm on January 2, for a staff holiday celebration **

Calendar

Dec 1 – Final day – Food Drive to support the Jackson Community Food Pantry

December 25 – Paramount office and financial markets closed for Christmas

Jan 1 – Paramount office and financial markets closed for the New Year holiday

Jan 2 – Paramount office will be closing 1:00 pm – 5:00 pm for a staff holiday celebration

Jan 15 – Financial Markets closed for MLK Day. Paramount office will be open

Jan 17 – 4th quarter 2023 estimated tax payments are due, if required

Feb 19 – Financial Markets closed for Presidents Day. Paramount office will be open.

Don Hershberger Named to Raymond James Chairman’s Council

As announced in the November 27th issue of Barron’s Magazine, Don Hershberger has been named to the Raymond James Chairmsn’s Council.

His dedication has made him a leader among Raymond James financial advisors, whose work is defined by his commitment to the pursuit of his client’s goals and their lasting financial well-being.

See the full list of Raymond James Chairman’s Council advisors at raymondjames.com/recognition.

Year-End Deadlines for Donor Advised Funds

If you plan on making year-end contributions to a Donor Advised Fund, make sure you are aware of these key deadlines.

Contributions into Donar Advised Fund

- December 8 – for networked mutual funds

- December 15 – for securities held at Raymond James

- December 15 – for wire transfers

- December 30 (Saturday) – checks must be postmarked by this date

Grants out of Donor Advised Fund

- December 15 – final day to submit grant reuests with reasonable expectation the check will distribute to the charity for the 2023 calendar year

Did You Know…

Client Access Single-Sign-On to your Donor Advised Fund

If you have a Client Access account, we can add a “View my Donor Advised Fund” button to your homepage so you can easily get into your Donor Advised Fund account with one click and without entering an additional username or password. Call Krystal in our office if you would like to turn on this feature. 517-787-4444.

New Legislation May Affect Your Philanthropic Strategy

Since 2006, philanthropically inclined IRA holders who are 70 1/2 or older have been able to transfer up to $100,000 each year directly from one or more IRAs to qualified charities without being taxed on the withdrawal. The donation is classed as a tax-free qualified charitable distribution or QCD.

Signed into law last December, the SECURE 2.0 Act incentivizes charitable donations by expanding the QCD rules. First, beginning in 2024, the $100,000 annual IRA QCD limit will be indexed for inflation. Within that annual QCD limit, you can now make a one-time-only distribution of up to $50,000 (also indexed for inflation) from one or more IRAs to a qualified “split-interest” entity – in this context, a charitable annuity trust (CRAT), charitable remainder unitrust (CRUT) or charitable gift annuity (CGA).

At first glance, the new split-entity QCD provision may appeal to tax-conscious donors who’d like to continue generating income from their donated assets. However, several critical caveats apply, so consult your team of professionals to understand the requirements and tax implications fully.

Three types of split-interest entities

Charitable remainder annuity trust (CRAT): The CRAT empowers you to fulfill your philanthropic intentions while capitalizing on immediate tax savings, and it provides a steady income for an extended period. You (or your beneficiaries) receive a fixed amount each year, and the remainder of the donated assets go to your chosen charities. To qualify within the new split-entity QCD provisions, the CRAT must be funded exclusively by QCDs, and the only income beneficiaries can be you, your spouse or the two of you.

Charitable remainder unitrust (CRUT): The CRUT also allows you to take advantage of immediate tax savings and provides income for you or your beneficiaries. The CRUT shares the same stipulations as the CRAT. It differs only in that the annual distribution is a set percentage of the trust, between 5% and 50%. Your named charities get the remainder.

Charitable gift annuity (CGA): Many large nonprofits offer charitable gift annuities. You donate to a single charity, which is set aside and invested. You get immediate tax savings and a fixed monthly or quarterly payment from the charity (supported by the investment account) for the rest of your life. At the end of your life, the charity receives the remainder of the gift. As with the CRAT and CRUT, the CGA needs to be funded exclusively by QCDs; fixed payments must exceed 5% of the contributed amount and begin within one year.

Other ways to contribute

There are other ways to use your IRA to make a difference to charities. From an estate planning perspective, consider putting your favorite charities as beneficiaries of your IRA.

Or you can name a donor advised fund (DAF) as the beneficiary of your IRA and list your children, grandchildren, or both as DAF advisors to reap the tax benefit of the donation while empowering your heirs to make grants from the DAF. This is one way to help your legacy live on.

A QCD could be a smart strategy to enhance your giving and win significant tax savings. Of course, it’s wise to take a holistic look at your entire estate and determine which assets you should leave to charities and which to your heirs, and then consider which strategies best fit your intentions. Talk to your advisor to learn about your options and how to take advantage of the SECURE 2.0 Act provisions.

Sources: fidelitycharitable.org; charitynavigator.org; irs.gov; forbes.com

The content provided herein is based on an interpretation by Raymond James of the SECURE Act 2.0 and is not intended to be legal advice or provide a tax opinion. Please discuss these matters with the appropriate professional. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

This material has been created by Raymond James for use by its financial advisors.

Food Drive Ending Soon

Today is the final day of our annual Food Drive to support the Jackson Community Food Pantry.

If you would like to bring in a donation, but are not able to make it today, please call the office at 517-787-4444 and ask for Carrie.

Paramount Wealth will double your efforts by matching the total non-perishable donations that are dropped off at our office.

“We make a living by what we get. We make a life by what we give”. Winston Churchill

Don Hershberger, CFP®, AIF®, CRC®, Founder and President, PWM, was named on the 2023 Forbes Top Wealth Advisor Best-in-State list.

2023 Forbes Top Wealth Advisors Best-In-State, developed by Shook Research, is based on the period from 6/30/2021 to 6/30/2022 and was released on 4/4/2023. 39,007 nominations were received and 7,321 advisors won. Neither Raymond James nor any of its advisors pay a fee in exchange for this award. More: https://go.rjf.com/3KsXbF7. Please see https://www.forbes.com/best-in-state-wealth-advisors for more info.

Any opinions are those of the author and are not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. All opinions are as of this date and are subject to change without notice.

Securities offered through Raymond James Financial Services, Inc. member FINRA/SIPC.

Please visit https://www.raymondjames.com/legal-disclosures/social-media-disclaimer-icd for Additional Risk and Disclosure Information. Raymond James does not accept private client orders or account instructions by email. This email: (a) is not an official transaction confirmation or account statement; (b) is not an offer, solicitation, or recommendation to transact in any security; (c) is intended only for the addressee; and (d) may not be retransmitted to, or used by, any other party. This email may contain confidential or privileged information; please delete immediately if you are not the intended recipient. Raymond James monitors emails and may be required by law or regulation to disclose emails to third parties.

Investment products are: Not deposits. Not FDIC or NCUA insured. Not guaranteed by the financial institution. Subject to risk. May lose value.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please reply to this message with “unsubscribe” in your response. You will continue to receive emails from us related to servicing your account(s).